Your Gateway to Ultra-Luxury Dubai

Pearl Bay Properties specializes in the acquisition of premium villas and penthouses in Dubai’s elite enclaves.

Expert advisory driven by the vision of Shaik Parvaiz and Balram Maganti.

The Dubai Luxury Residential Market: A Global Haven

Dubai's luxury residential real estate market is globally unparalleled, serving as the world's leading magnet for High-Net-Worth Individuals (HNWIs). This vibrant sector is currently experiencing an unprecedented period of sustained growth, solidifying Dubai's reputation as a premier global wealth hub.

Key Market Dynamics:

Sustained Capital Appreciation: Prime areas like Palm Jumeirah, Downtown Dubai, and Emirates Hills continue to see robust price growth, driven by limited, exclusive inventory and soaring international demand.

A Magnet for Global Wealth: Favorable government policies, including the Golden Visa program and an attractive tax-free environment, are fueling a significant influx of affluent buyers seeking both stable investment and a world-class lifestyle.

The Rise of 'Liveability': Modern luxury buyers prioritize more than just opulence; they seek wellness-focused living, integrated smart home technology, and unparalleled security in master-planned, amenity-rich communities.

Unrivaled Value Proposition: Despite commanding record prices, Dubai's ultra-luxury properties often remain more competitively priced than comparable assets in London or New York, while offering superior gross rental yields.

Global Presence, Local Trust

Seamlessly Connecting Indian Wealth to Dubai’s Skyline

At Pearl Bay Properties, we provide a dedicated corridor for investors across India to access Dubai’s most lucrative real estate opportunities. We bridge the gap between Indian financial regulations and Dubai’s luxury market, providing a local point of accountability for a global investment.

The Pearl Bay Advantage for Indian Investors

Nationwide Advisory Excellence: Whether you are based in Mumbai, Delhi, Hyderabad, or Bangalore, our leaders—Shaik Parvaiz and Balram Maganti—is available for private digital or in-person consultations, combining the comfort of a local partnership with the reach of Dubai expertise.

Mastery of LRS & FEMA Regulations: We ensure compliant international property acquisition by guiding you through the Liberalised Remittance Scheme (LRS), allowing individuals to remit up to $250,000 per year or families to pool limits for high-value assets.

The Golden Visa Gateway: We specialize in residency-linked investments. For acquisitions of AED 2 Million (~₹4.6 Cr) or more, we facilitate the 10-year UAE Golden Visa process, securing long-term residency for you and your family.

Tax-Efficiency & DTAA Guidance: We help you navigate the tax benefits of the India-UAE Double Taxation Avoidance Agreement (DTAA). Enjoy Dubai’s 0% capital gains and rental income tax environment while ensuring full compliance with Indian tax disclosures.

End-to-End Asset Management: Our relationship doesn't end at the handshake. From legal documentation in India to property management and high-yield resale in Dubai, we handle the complexities so you can enjoy the returns.

"A local hand to guide you, a global vision to grow your wealth."

About Us: Pearl Bay Properties

At Pearl Bay Properties, we don't just facilitate transactions; we curate access to the most exclusive and aspirational residences in Dubai. With over twenty years of experience at the core of Dubai’s thriving economy, we provide a sophisticated bridge for global investors and entrepreneurs, transforming complex market entry into a seamless, results-driven journey.

Our focus is laser-sharp: The High-End Luxury Residential Market and Strategic Business Formation. We are the trusted advisory firm for those who seek assets that are more than just homes—they are legacies.

The Pearl Bay Specialization: A 360° Approach

We provide a rare dual expertise that allows us to bridge the gap between your private real estate portfolio and your corporate growth objectives.

I. Real Estate Advisory & Asset Management

We maintain a comprehensive command of the property market—spanning off-plan investments, asset and tenant management, and property sales.

Legacy Assets: Exclusive access to one-of-a-kind, often off-market properties in Dubai’s elite enclaves.

Data-Driven Insights: Precision-led analysis of capital appreciation and emerging growth corridors.

Full-Cycle Management: End-to-end oversight ensuring optimized rental yields and long-term asset health.

II. Corporate Structure & Business Formation

We bring extensive expertise in company formation across Free Zone, Mainland, and Offshore jurisdictions, ensuring clients achieve optimal licensing and regulatory compliance.

Seamless Market Entry: Managing jurisdictional selection, corporate banking coordination, and international logistics.

Compliance Mastery: Navigating UAE Economic Substance (ESR) and evolving regulatory standards.

Corporate Growth: Facilitating the infrastructure needed for businesses to operate seamlessly across borders.

Led by Visionaries:

Shaik Parvaiz & Balram Maganti

Pearl Bay Properties is driven by the dynamic vision and profound market insight of its leadership team, Shaik Parvaiz and Balram Maganti.

A Foundation of Trust & Expertise: Shaik and Balram bring a powerful blend of global business acumen and deep local market expertise. They founded Pearl Bay with a singular mission: to provide a discreet, professional service uniquely tailored to the requirements of the ultra-luxury client.

Beyond the Deal: Their philosophy extends beyond brokerage. The leadership ensures every client engagement is rooted in transparency, integrity, and long-term partnership. They are committed to securing not just a property, but the perfect asset that aligns with their clients' wealth strategy and lifestyle aspirations.

This dual specialization positions us to provide end-to-end strategic advisory that few firms can match. Whether guiding an investor through Dubai’s property landscape or structuring a multinational’s regional presence, our goal is to create sustainable, results-driven pathways to success.

"At Pearl Bay, we don't just provide services—we build legacies.

We work alongside entrepreneurs, investors, and global businesses to transform vision

into measurable achievement within one of the world’s most dynamic markets."

Properties Available

Al Barari

Exclusive eco-luxury surrounded by nature

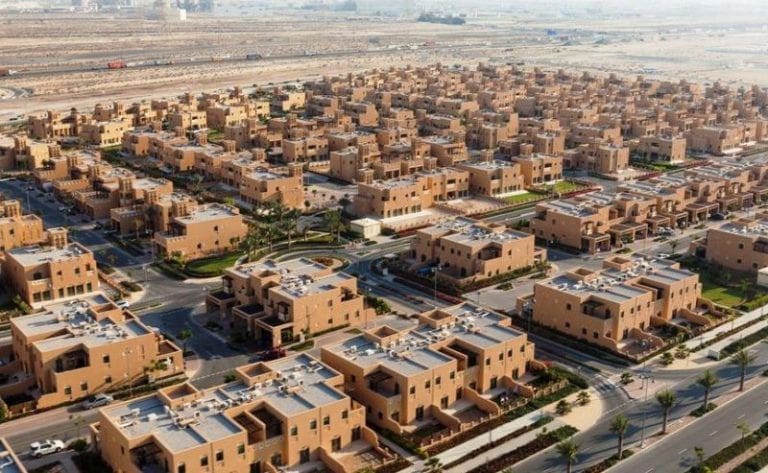

Motor City

Family-friendly homes with community charm

MBR City

Ultra-luxury residences near Downtown Dubai

Mina Rashid

Seafront heritage living with modern luxury

Al Furjan

Well-connected homes for growing families

Dubailand

Affordable living with future-ready growth

FAQ's

1. Is it legal for an Indian resident to buy property in Dubai?

Yes. Under the Liberalized Remittance Scheme (LRS) established by the RBI, Indian residents are legally permitted to invest in immovable property abroad. As long as the funds are remitted through authorized banking channels and comply with the annual limits, you can hold full freehold title to a property in Dubai.

2. How much money can I send from India to Dubai each year?

Under current LRS guidelines, a resident individual can remit up to USD 250,000 (approximately ₹2.1 Crores) per financial year.

Pro-Tip: For higher-value properties, families can pool their limits. For example, a family of four can legally remit up to USD 1 Million in a single financial year, provided all four members are listed as co-owners on the property title deed.

3. Can I buy property in my spouse’s name or jointly?

Absolutely. Dubai law allows for joint ownership between spouses, family members, or business partners. In fact, if you are pooling LRS limits from India, it is a requirement that the contributing family members are added to the Sale & Purchase Agreement (SPA) and the subsequent Title Deed.

4. How do I qualify for the 10-Year Golden Visa?

In 2025, the criteria for the Golden Visa through real estate remains highly attractive for Indian investors:

Investment Threshold: A minimum property value of AED 2 Million (approx. ₹4.6 Crores).

Flexibility: This can be a single property or a portfolio of multiple properties totaling AED 2M.

Off-Plan: You can apply even for off-plan properties, provided the total value reaches the threshold.

Mortgages: If you take a mortgage from a UAE bank, you are still eligible as long as the total value is AED 2M or more.

5. What are the tax implications in India for my Dubai property?

Dubai itself has 0% property tax and 0% tax on rental income. However, as a resident of India:

Rental Income: Must be declared in your Indian ITR and is taxed as per your applicable slab.

Capital Gains: If you sell the property, capital gains tax is applicable in India.

DTAA Benefits: Thanks to the India-UAE Double Taxation Avoidance Agreement (DTAA), you are protected from being taxed twice on the same income. We recommend consulting with our empanelled tax experts for specific portfolio planning.

6. Can I get a home loan in Dubai as an Indian resident?

Yes. Many UAE banks offer mortgages to "Non-Resident Indians" (NRIs). Generally, you can get financing for up to 50% to 75% of the property value.

Note: The down payment must be remitted from India via the LRS route, and the loan must be serviced through official banking channels to remain FEMA compliant.

7. Do I need to travel to Dubai to complete the purchase?

No. We can facilitate the entire process remotely. Through a Power of Attorney (POA), we can handle the registration at the Dubai Land Department (DLD) on your behalf. Many developers also offer digital booking systems and virtual tours, allowing you to secure your investment from the comfort of your home in India.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2026. Pearl Bay Properties. All Rights Reserved.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.